Meta’s $200B AI Problem: Big Spending, No Big Product

The smartest move might not be the most expensive one.

Meta is spending like there’s no tomorrow — but Wall Street isn’t convinced there’s a tomorrow worth buying.

In its latest earnings call, Meta revealed another $20 billion in quarterly AI and infrastructure costs. Mark Zuckerberg says it’s an “investment in the future,” but that future still feels abstract — even for Silicon Valley.

Zuckerberg’s defense was clear: Meta needs massive compute power for the next generation of frontier AI models being built by its new Superintelligence Lab. But investors were hoping for something more tangible — a real product, not another promise.

The market’s verdict was harsh: Meta’s stock dropped 12% in two days, wiping out nearly $200 billion in market cap. Not because of bad profits (Meta still made $20 billion), but because no one can see where those billions in AI spending are actually going.

The uncomfortable truth? Meta doesn’t have a breakout AI product yet.

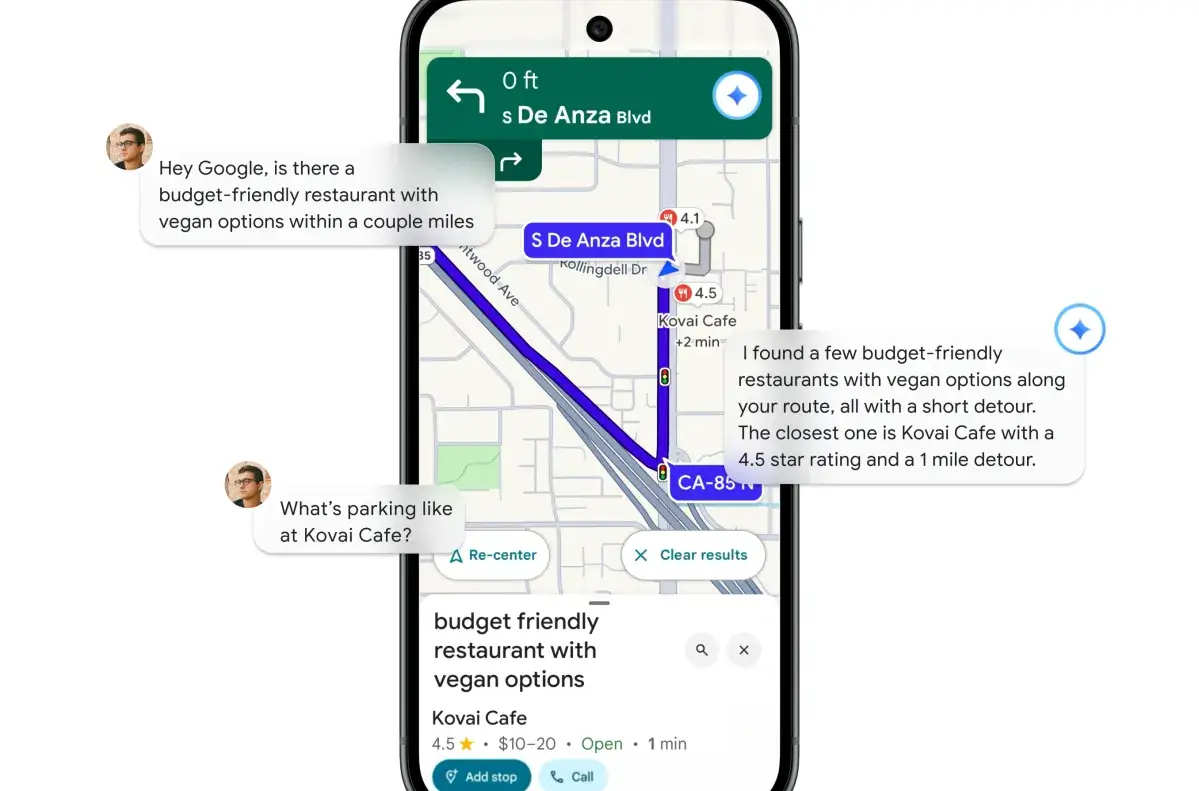

Meta AI, the in-app assistant, rides on the back of Facebook and Instagram’s 3B+ users, but it’s far from being a true ChatGPT rival.

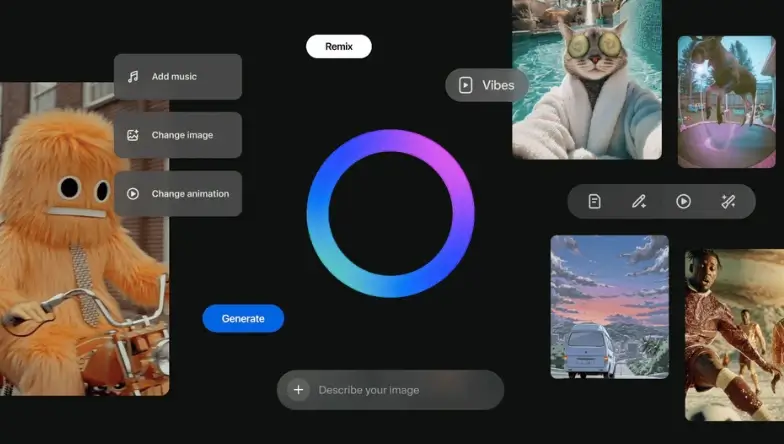

Vibes, Meta’s short video generator, boosted engagement but barely nudged revenue.

Vanguard smart glasses look exciting, but they’re more of a hardware experiment than a generative AI leap.

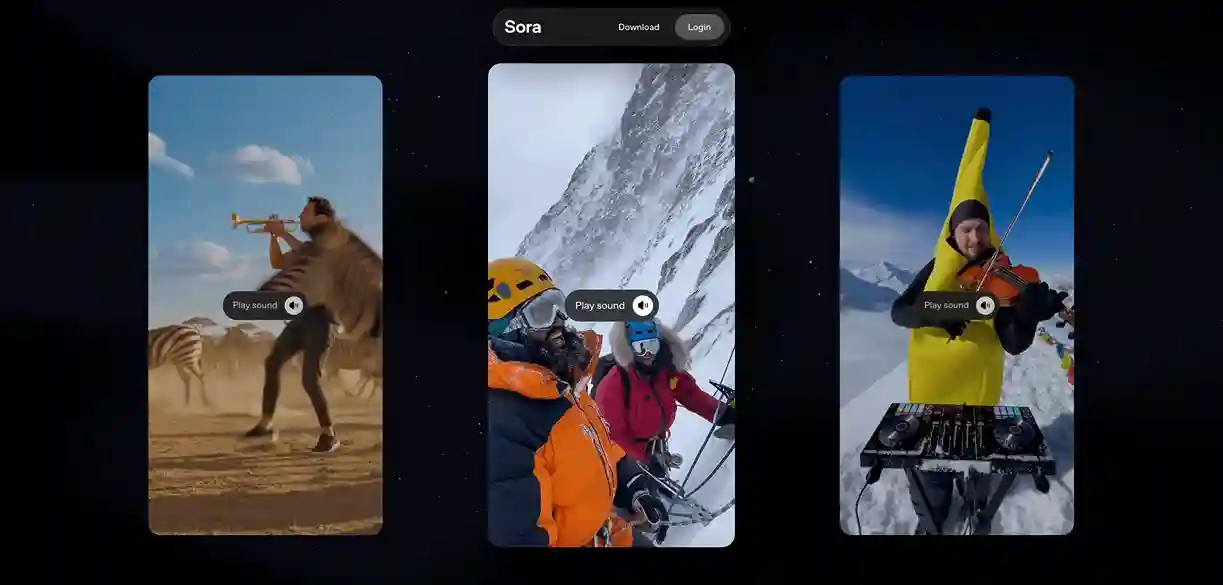

While OpenAI can justify its spending with over $20B in annual recurring revenue and Google continues to monetize AI across its search and cloud products, Meta’s vision feels scattered — like a collection of AI experiments searching for a narrative.

Zuckerberg’s comments hinted at something bigger: “We expect to build novel models and novel products.” But this was an earnings call, not a launch event. Investors don’t want “novel.” They want results.

It’s been four months since Meta restructured its AI division under the Superintelligence Lab, and while early-stage research takes time, the market is impatient. Spending billions without a visible product roadmap is making Meta’s AI bet look like a moonshot without coordinates.

The irony? Meta has one of the largest user data sets in the world — a treasure chest of context that could power smarter, more personal AI assistants or enterprise tools. Yet, so far, that data advantage hasn’t translated into market impact.

Maybe Meta is building quietly for something transformative — an AI ecosystem that fuses social, entertainment, and productivity. Or maybe, it’s caught between ambition and clarity.

Either way, one thing is certain: The AI race is no longer about who spends the most, but who ships the fastest.

And right now, Meta’s runway looks expensive — and empty.

Read Meta’s full Q3 earnings statement here: Meta Investor Relations

You may like recent updates...

Subscribe & Get Free Starter Pack

Subscribe and get 3 of our most templates and see the difference they make in your productivity.

Free Starter-Pack

Includes: Task Manager, Goal Tracker & AI Prompt Starter Pack

We respect your privacy. No spam, unsubscribe anytime.

Featured*

QuillBot

AI tool that improves writing with smart paraphrasing, grammar checks & image generation.

Carepatron

AI platform for managing healthcare workflows, notes, and patient collaboration.

Sanebox AI

AI tool organizes your inbox by automatically sorting emails and reducing clutter.