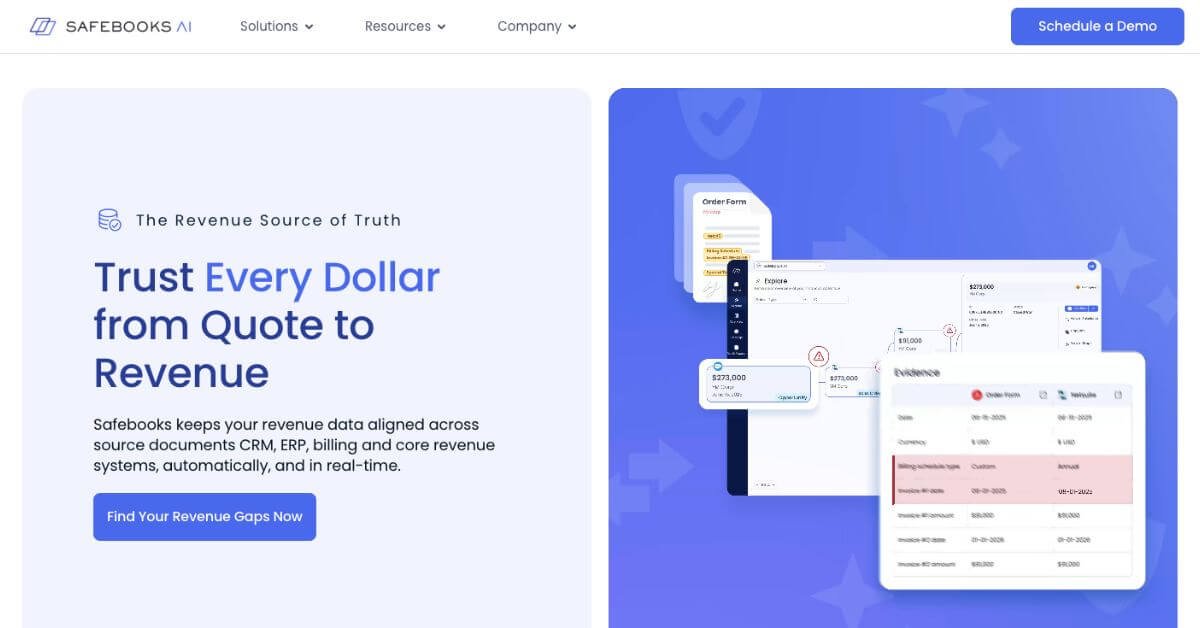

Safebooks AI

Autonomous revenue data governance for finance teams managing complex systems.

Safebooks AI Review: Autonomous Financial Data Governance for Revenue Teams

Modern finance teams operate across fragmented systems—CRM, CPQ, ERP, billing, and contracts—that rarely stay in sync. As deal volume grows, data mismatches creep in silently. Bookings stall, billing disputes rise, revenue leaks go unnoticed, and audit prep turns into a fire drill. Most teams rely on spreadsheets and manual checks as temporary fixes, but these don’t scale and often surface issues only after revenue is already impacted.

Safebooks AI addresses this by acting as a continuous financial data governance layer across the entire quote-to-revenue lifecycle. Instead of fixing problems after the fact, it automatically reconciles data across systems in real time, reviews contracts and deals against revenue policies, and enforces controls while transactions are still in motion. This allows finance teams to trust every dollar, close faster, prevent leakage early, and maintain audit-ready accuracy without manual intervention.

Quick Summary

Safebooks AI is an enterprise-grade financial data governance platform built to verify, reconcile, and govern revenue data across CRM, ERP, billing, and source documents in real time.

Is it worth using? Yes—if your organization manages complex quote-to-revenue workflows and needs continuous, audit-ready accuracy without manual checks.

Who should use it? Finance Ops, Revenue Accounting, Controllers, and Finance leadership at mid-market to enterprise companies.

Who should avoid it? Early-stage startups or small teams without multi-system revenue complexity.

Verdict Summary

Best for

Enterprises with fragmented revenue stacks (CRM, CPQ, ERP, billing)

Finance teams dealing with revenue leakage, delayed closes, or audit pressure

Organizations seeking continuous, automated revenue validation

Not for

Small businesses with simple billing setups

Teams looking for lightweight reporting or forecasting tools

Overall Rating: ⭐⭐⭐⭐☆ (4.5 / 5)

Safebooks AI stands out for continuous reconciliation and real-time policy enforcement across the full quote-to-revenue lifecycle.

What Is Safebooks AI?

Safebooks AI is a financial data governance platform designed to help enterprises sign off on 100% of their revenue data. Instead of relying on spreadsheets, periodic checks, or manual reviews, it continuously verifies revenue-critical data as it moves across systems.

The platform applies machine-learning–driven validation to surface fraud risks, compliance gaps, and data mismatches early—before they affect bookings, billing, or audits. It acts as a live control layer between CRM, contracts, ERP, billing, and revenue systems, giving finance teams a single source of truth from quote to cash.

How Safebooks AI Works

Safebooks AI connects directly to your revenue stack—CRM, CPQ, billing, ERP, and supporting documents.

As data flows:

It reconciles key fields across systems in real time

Reviews contracts and deals against revenue policies

Enforces rules automatically before errors propagate

Flags risks instantly, with full traceability for audits

The result is continuous revenue integrity without cleanup cycles or manual intervention.

Key Features

Automated Revenue Reconciliation across CRM, billing, and ERP

AI-powered contract and deal reviews against revenue policies

Real-time policy enforcement during live transactions

End-to-end traceability from quote to invoice to payment

Revenue leakage detection before close or audit

Enterprise-grade compliance (SOC 1 Type 2, SOC 2 Type 2, ISO 27001)

Real-World Use Cases

Finance Operations: Keep quotes, contracts, and orders aligned before they hit ERP

Controllers: Close faster with continuous reconciliation and full data coverage

Revenue Accounting: Validate ASC 606 schedules with complete traceability

Finance Leadership: Identify silent revenue gaps and accelerate cash flow

Pros and Cons

| Pros | Cons |

|---|---|

| Continuous, real-time reconciliation | No self-serve pricing |

| Eliminates manual spreadsheets | Enterprise-focused implementation |

| Early detection of revenue leakage | Overkill for small teams |

| Audit-ready data at all times | Requires multi-system setup |

| Scales without adding headcount | Demo-based onboarding |

Pricing & Plans

Safebooks AI follows an enterprise pricing model.

Pricing is not publicly listed

Cost depends on system complexity, data volume, and use cases

Free plan: No

Entry requires a scheduled demo with the Safebooks team

This pricing structure aligns with large finance teams managing complex revenue flows.

Best Alternatives & Comparisons

If Safebooks AI feels too enterprise-heavy, consider these alternatives:

Zuora Revenue – Strong for subscription revenue accounting

Chargebee RevRec – Focused on SaaS billing and revenue recognition

BlackLine – Known for financial close and reconciliation workflows

NetSuite Revenue Management – ERP-native revenue controls

Safebooks differentiates itself by operating as a continuous governance layer, not just a reporting or close tool.

Frequently Asked Questions (FAQ)

It supports revenue recognition workflows but focuses more on continuous data validation and governance across systems.

No. It sits between systems as a control and reconciliation layer.

Yes. Every data point is traceable, making audits faster and more predictable.

Yes, especially SaaS businesses with complex contracts, usage billing, or multi-entity revenue.

No. The platform is designed to operate autonomously once configured.

Final Recommendation

Safebooks AI is a strong fit for enterprises that struggle with revenue data gaps, delayed closes, or audit pressure across multiple systems. It replaces reactive cleanup with continuous governance, helping finance teams trust every dollar from quote to revenue.

Next steps:

Visit the official Safebooks website and request a demo

Compare Safebooks with other revenue integrity platforms

List your AI tool on itirupati.com to reach a finance-focused audience